Unlocking Financial Freedom

"Rich Dad Poor Dad" by Robert Kiyosaki stands as a beacon of financial enlightenment, guiding readers towards a path of wealth and prosperity. Dive into this comprehensive summary, packed with actionable insights and strategic keywords to empower your journey towards financial independence.

Introduction to "Rich Dad Poor Dad"

"Rich Dad Poor Dad" isn't just a book; it's a revolution in financial thinking. It redefines the norms, urging readers to break free from financial mediocrity through education and strategic decision-making.

Background of the Author:

Robert Kiyosaki, a renowned entrepreneur and investor, authored "Rich Dad Poor Dad" based on his personal experiences and insights gained from his two influential father figures. His mission? To disrupt conventional financial paradigms and empower individuals to take control of their financial destinies.

Key Concepts in "Rich Dad Poor Dad"

The book introduces transformative concepts that challenge traditional beliefs about wealth and success. Keywords like mindset, assets, and financial independence lay the groundwork for a paradigm shift towards financial empowerment.

The Rich Dad's Philosophy

Central to Kiyosaki's teachings is the philosophy of leveraging resources to create wealth. By making money work for you through strategic investments in income-generating assets, you pave the way for lasting financial prosperity.

The Poor Dad's Mentality

In contrast, the "poor dad" mentality symbolizes a reliance on traditional employment and a fear of financial risk. Keywords like security, comfort, and scarcity characterize this mindset, which often leads to financial stagnation.

Lessons for Financial Success

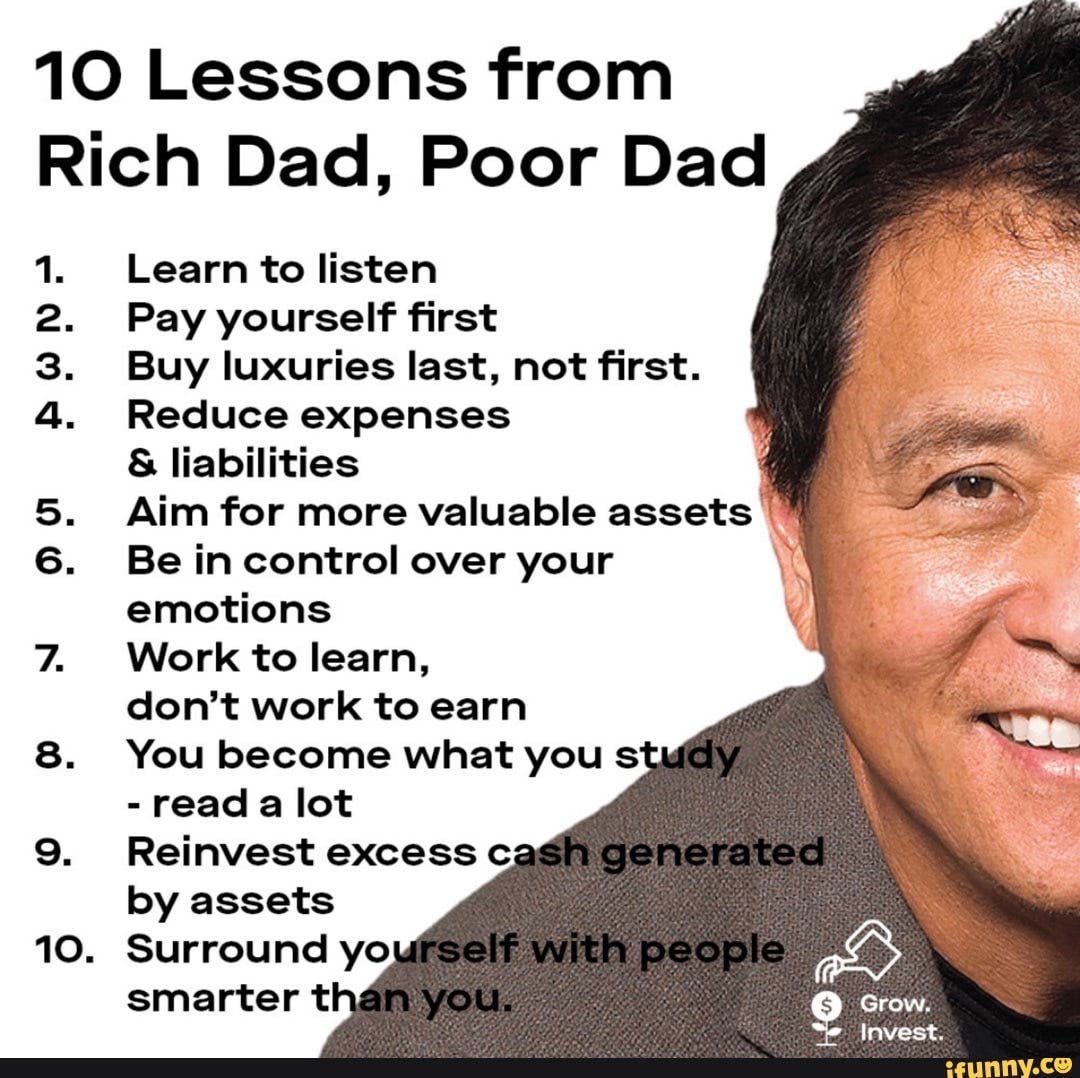

Kiyosaki imparts invaluable lessons on the importance of lifelong learning, courage, and creating passive income streams. Armed with these keywords, readers are equipped to navigate the complexities of wealth accumulation and financial freedom.

Application of Principles in Real Life

"Rich Dad Poor Dad" doesn't just offer theory; it provides a roadmap for practical application. Through real-life examples and actionable steps, readers learn how to translate knowledge into tangible results, making keywords like action, strategy, and implementation their allies.

Criticism and Controversies

Despite its widespread acclaim, "Rich Dad Poor Dad" has faced its share of skepticism. Yet, Kiyosaki's unwavering defense of his principles and the tangible results experienced by readers serve as a testament to the book's enduring relevance.

Impact and Legacy

The impact of "Rich Dad Poor Dad" transcends mere financial gains; it's about empowerment and transformation. Testimonials from individuals who have achieved financial success using Kiyosaki's principles underscore the book's lasting legacy and its role in shaping financial education worldwide.

In "Rich Dad Poor Dad," Robert Kiyosaki introduces several key concepts that are pivotal to understanding his philosophy of wealth creation and financial freedom. Let's delve deeper into these concepts:

Mindset Contrast: Rich Dad vs. Poor Dad

Kiyosaki vividly contrasts the mindsets of his two father figures: his biological father (poor dad) and the father of his best friend (rich dad). The poor dad represents the conventional mindset of working hard for money, often stuck in the cycle of living paycheck to paycheck. On the other hand, the rich dad embodies a mindset focused on financial intelligence, leveraging resources, and making money work for you. This juxtaposition highlights the transformative power of mindset in shaping one's financial destiny.

Assets vs. Liabilities

A core principle of "Rich Dad Poor Dad" is the distinction between assets and liabilities. Kiyosaki defines assets as income-generating resources that put money in your pocket, such as real estate, stocks, and businesses. In contrast, liabilities are expenses that take money out of your pocket, such as mortgages, car loans, and credit card debt. Understanding this distinction is essential for building wealth, as it encourages individuals to focus on acquiring assets that generate passive income while minimizing liabilities.

Pursuit of Financial Independence

Central to Kiyosaki's teachings is the pursuit of financial independence. He emphasizes the importance of breaking free from the traditional paradigm of trading time for money and instead striving to achieve financial freedom, where passive income exceeds expenses. This shift in mindset empowers individuals to reclaim their time, pursue their passions, and live life on their own terms.

Expanding on Application of Principles in Real Life

"Rich Dad Poor Dad" not only provides theoretical insights but also offers practical guidance on how to apply these principles in real life. Let's explore some actionable steps outlined in the book:

Practical Steps towards Financial Freedom

Kiyosaki lays out a roadmap for achieving financial freedom, which includes steps such as reducing expenses, increasing income streams, and investing wisely. He encourages readers to create a financial plan tailored to their goals and circumstances, emphasizing the importance of disciplined saving and strategic wealth accumulation.

Case Studies Exemplifying Success

Throughout the book, Kiyosaki shares numerous case studies and examples of individuals who have successfully implemented his principles to achieve financial success. These real-life success stories serve as inspiration and provide concrete examples of how the principles outlined in "Rich Dad Poor Dad" can be applied in diverse situations.

Investment Strategies for Different Income Levels

Kiyosaki acknowledges that not everyone starts from the same financial position and provides tailored investment strategies for individuals at different income levels. Whether you're just starting out with limited resources or already have a substantial net worth, "Rich Dad Poor Dad" offers practical advice on how to build wealth systematically and sustainably.

Expanding on these key concepts and practical applications provides readers with a deeper understanding of the transformative power of "Rich Dad Poor Dad" and equips them with the knowledge and tools to embark on their own journey towards financial freedom.

Conclusion

In conclusion, "Rich Dad Poor Dad" isn't just a book; it's a blueprint for financial liberation. Armed with the knowledge and insights gleaned from its pages, readers are empowered to embark on a journey towards financial abundance and fulfillment.

Unique FAQs

-

Is "Rich Dad Poor Dad" suitable for beginners in personal finance? Absolutely! Kiyosaki's conversational style and relatable anecdotes make the book accessible to readers of all financial backgrounds.

-

Does "Rich Dad Poor Dad" provide specific investment advice? While the book offers general principles for financial success, it's essential to conduct further research and seek professional advice before making investment decisions.

-

Are there any follow-up books or resources recommended by Robert Kiyosaki? Yes, Kiyosaki has authored several other books and offers seminars and online courses for those interested in delving deeper into his teachings.

-

Can the principles in "Rich Dad Poor Dad" be applied to any economic environment? Yes, the core principles of financial literacy and investing remain relevant regardless of the economic climate.

-

How long does it typically take to see results from implementing the strategies in the book? Results vary depending on individual circumstances, but with dedication and persistence, readers can begin to see positive changes in their financial situation over time.

You must be logged in to post a comment.